crypto

Unlocking the Power of Crypto30x – A New Frontier in Cryptocurrency Trading

The market for cryptocurrency trading has seen an exponential increase during the past few years. new platforms and trading tools constantly appear, offering traders new methods to increase profits while minimizing risk. One of these is Crypto30x has begun to draw interest. What exactly is Crypto30x and why has it created such a hype? Let’s look at the possibilities of Crypto30x and what it could mean to the direction of cryptocurrency trading.

What is Crypto30x?

The term “Crypto30x” is most likely referring to an exchange platform or tool that offers 30-fold leverage in the cryptocurrency trading. Leverage in trading is the capability to manage an amount that is greater than the capital the trader has on their accounts. With leverage that is 30x traders can increase their earnings by 30x however this comes at greater risk.

For instance when a trader has an account with $1,000 and is using leverage of 30x the possibility is that they can trade a cryptocurrency worth $30,000. If the market performs to their advantage the profits could be significant. However, the disadvantage is that, if the market goes against them, their losses will be equally accentuated.

Why 30x Leverage?

Leverage is among the most effective tools that any trader can have in their arsenal. Given the turbulence that is the crypto market even a slight change in price could result in huge losses or gains. Utilizing leverage such as 30x lets traders make the most profit from these price fluctuations without having to spend large amounts of capital up front.

However, leverage must be utilized with caution particularly in the volatile realm of cryptocurrency. If traders are trying to take advantage of the short-term fluctuations in prices or swing trades could be a means to gain significant profit. However, for novices or people who aren’t experienced it can result in massive losses.

Benefits of trading with Crypto30x

- Better Profits Potential with 30x leverage that is just a little variation in the market for cryptocurrency can result in increased profits. If you are a skilled trader that are skilled, this could translate into more money in a short period of time.

- Capital Efficiency Leverage allows traders to manage larger positions without the need to commit an entire quantity of capital. This enables traders for diversification of their portfolios and make the most of a variety of opportunities simultaneously.

- Access to different Cryptocurrency Markets A variety of platforms that provide 30x leverage allow access to different cryptocurrency, such as Bitcoin, Ethereum, and altcoins. This lets traders play with different currencies and adapt their strategies according to market conditions.

- short-term profit opportunities In light of the risk of volatility in the cryptocurrency market 30x leverage could allow traders to benefit from the rapid price fluctuations, both in bearish and bullish movements.

The risks of trading with Crypto30x

- Higher risk of losing The greater you leverage the higher the chance of losing. A tiny market move that is not in your favor could erase your position completely. It is essential to have a sound strategy for managing risk when dealing with leverage.

- Margin Calls If the value of your investment decreases above the threshold of a certain amount and you are required to pay additional money to keep your position. If you do not, it may result in a liquidation process that is automatic and result in substantial losses.

- Volatility The market for cryptocurrency is known to be volatile. Price swings that are sudden could result in substantial gains and losses, particularly when trading at high leverage. Traders should be prepared for rapid decisions and not trade more than they are willing to risk losing.

- The emotional strain Trading with high leverage can be emotionally stressful, since massive price swings can lead to abrupt changes in the value of your portfolio. This can result in impulsive choices, which could harm long-term profits. gardens

How to Use Crypto30x Responsibly

The lure of huge returns can be tempting however, it is crucial for traders to use leverage with a cautious approach. Here are some tips to make sure you’re trading responsibly with Crypto30x or any other leverage tool:

- Start small Start with less leverage in order to become familiar of the market’s volatility as well as the mechanics in the marketplace. This can help reduce risks while also gaining knowledge.

- Set Stop-Loss orders Help protect your investments by setting stop-loss order. The order will be automatically closed position in the event that the market moves in your direction by a certain amount, which will help limit the loss you suffer.

- Do Thorough Research Be aware of the latest market news, trends, and changes. Markets for cryptocurrency can be volatile and therefore, informed decisions regarding trading are vital.

- risk management Use only the funds you have the money to lose. Leverage increases both losses and profits therefore, you must ensure that your risk exposure is consistent with your investment strategy overall.

The Future of Crypto30x and Cryptocurrency Trading

Crypto30x and other leverage-based platforms will likely to play an important role in trading on cryptocurrency. As the cryptocurrency market grows and more traders get familiar with the risks and rewards of trading Tools like Crypto30x are likely to get more popular. But the long-term viability of these platforms will rely the ability of these platforms to manage the risk-management aspect with opportunities for high returns.

The most important lesson for anyone interested in trading Crypto30x is to be aware of the rewards and risks that come with high-leverage trading. Education, risk management and a well-planned approach are vital to navigating this fascinating but unstable market

crypto

Is Copy Trading for Real?

Copy trading has recently gained immense popularity. At first glance, copy trading seems like the ideal investment solution, allowing people to invest without fully relying on their own expertise and mirroring professional traders’ trades automatically. But is can effective investment strategy or just another fad? Let’s unpack copy trading to determine its validity as an approach. Curious about the reliability of copy This main page connects investors with experts who break down its mechanics—how do you plan to evaluate its potential?

Assessing Authenticity: Is Copy Trading An Appropriate Investment Strategy?

Copy first gained prominence during the early 2000s as a method for novice investors to learn from experienced traders by following in their footsteps on platforms explicitly designed to enable it. At its core, involves following successful investors closely while mirroring their trades through these services.

But the question still stands–can a strategy reliant on someone else’s judgment consistently produce results? In order to answer this, one must understand that copy trading does not promise profits and should only be seen as a tool that aligns your investments with those made by experienced traders.

Take it from financial educator Sarah Johnson, who once said, “Copy is like learning to cook from a chef. Mirroring their techniques can yield great results, but only if the chef actually knows what they’re doing.” That means your success rests heavily on selecting the right investor to follow.

Transparency is another consideration. Platforms offering copy must disclose the historical performance of traders you aim to copy. Some platforms go a step further, offering risk scores and detailed analytics to guide decisions. Be cautious and always verify the credibility of both the platform and the trader you’re copying.

Advantages Of Engaging In Copy Trading

Why has copy attracted thousands of investors? There are several reasons why it feels appealing, especially for those new to the market.

- Accessibility for Beginners: You don’t need to be an expert in stocks, commodities, or forex to start. Beginners can piggyback on the expertise of seasoned traders.

- Learning Opportunity: While you’re copying trades, you’re also learning. Watching market decisions in real-time can help you understand patterns and strategies over time.

- Time Saving: For individuals juggling work, family and other obligations simultaneously, keeping close tabs on investments may not be feasible; in such a situation, copy trading offers an easy alternative while still participating in active markets.

- Diversification: You can diversify by following multiple traders who specialize in different markets or strategies, spreading out the risk across a range of assets.

However, even the most attractive benefits come with tradeoffs. While copy trading makes investing easier for some investors, it still requires effort and dedication for success; simply following someone else’s portfolio without understanding its strategy could prove disastrous.

Navigating Risks And Challenges In Copy Trading

Copy trading can present its share of challenges. Betting any amount on someone else’s decisions entails risks that you cannot predict; be wary if anyone offers you money.

No Strategy Is Foolproof

Even expert traders can make bad calls. Markets are unpredictable at the best of times, and following someone else doesn’t provide immunity against losses.

Over-Reliance On Others’ Decisions

While convenience is appealing, depending entirely on another person’s strategies means you might not build your own investment acumen. If the trader you’re following falls out of the market, you could be left scrambling.

Hidden Costs

Some platforms impose fees for using copy-trading features. These costs might pile up over time and reduce the overall return on your investment.

Mismatched Risk Preferences

An expert trader’s risk tolerance could differ greatly from your own. For example, if you’re a conservative investor following someone more aggressive, their strategies could leave you in financial discomfort.

“Trust, but verify,” says investment advisor Michael Kingsley. “Don’t follow a trader simply because their profile looks shiny. Dig deeper. Ask questions like, ‘What’s their risk level? Do their previous results match what I’m comfortable with?’”

Ultimately, copy trading works best when approached with caution and thoughtfulness. Research is your friend. Look for platforms with a solid reputation and take the time to assess traders based on performance, experience, and risk appetite.

Asking The Big Question

Given all the advantages and risks, part of deciding if copy trading is “real” comes down to asking the right questions. Here are some to get you started:

- Does the platform have safeguards in place to manage risks?

- Is there transparency in a trader’s performance statistics?

- How does copying align with my financial goals and risk tolerance?

- Am I willing to invest time in monitoring and evaluating the traders I follow?

Remember, informed investing is responsible investing.

What Should You Do Next?

Instead of jumping into copy trading without preparation, start by doing your homework. Explore reputable platforms, read reviews, and even consult a financial expert. Remember the golden rule of investing—never risk more than you’re ready to lose. Choosing where your money flows is a decision worthy of time and care.

Copy trading is neither a shortcut to riches nor a guaranteed path to failure. It’s a tool, and much like any tool, its effectiveness depends entirely on how you use it.

Conclusion

Copy trading offers a tempting shortcut for beginners, but it’s not a guaranteed ticket to success. While it can help tap into expert strategies, blindly following others comes with risks. Understanding the process and choosing wisely are key. In the end, copy trading can be real, but it works best when combined with research and a clear investment strategy.

-

Tech5 months ago

Tech5 months agoFintechZoom.com – Your Ultimate Guide to Financial News and Insights

-

Tech4 months ago

Tech4 months agoKittl Design: A Simple Guide to Boosting Your Creative Projects

-

Celebrity4 months ago

Celebrity4 months agoWhat Disease Does Michael Keaton Have?

-

Tech5 months ago

Tech5 months agoHow to Track a Phone Number on Google Maps

-

Tech4 months ago

Tech4 months agoCute Canva Fonts: A Guide to Adding Charm to Your Designs

-

Blog4 months ago

Blog4 months agoTimberwolves vs Phoenix Suns Match Player Stats

-

Entertainment4 months ago

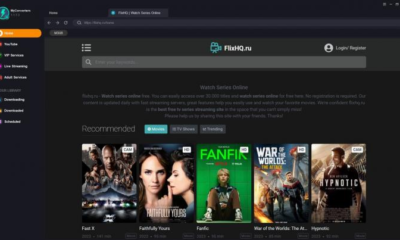

Entertainment4 months agoFlixHQ – Top 10 FlixHQ Alternatives to Watch HD Movies and TV Shows in 2025

-

Tech4 months ago

Tech4 months agoCute Fonts on Canva: A Guide to Adorable Typography for Your Designs