crypto

Understanding Crypto 30x Leverage: What It Means for Traders

Cryptocurrency trading has grown exponentially in recent years, offering new opportunities and challenges for both novice and experienced traders. One such feature that has gained significant attention is 30x leverage. Leverage in crypto trading allows traders to open positions larger than their initial capital, increasing both potential profits and risks. In this article, we’ll explore crypto 30x leverage, how it works, the benefits, risks, and some tips on how to use it effectively in your trading strategy.

What Is Leverage in Crypto Trading?

Leverage is a fundamental concept in trading, whether in the stock market, forex, or cryptocurrency. Essentially, leverage allows a trader to control a larger position in the market than the amount of capital they actually have. The amount of leverage a trader can use is expressed as a multiple of their margin. For instance, with 30x leverage, a trader can control a position 30 times larger than their investment.

Example:

If a trader has $1,000 in their account and uses 30x leverage, they can trade a position worth $30,000. This means the trader is using borrowed funds from the exchange or broker to amplify their position size.

How Does Crypto 30x Leverage Work?

Crypto 30x leverage works by allowing traders to open larger positions using a small portion of their capital as margin. In simple terms, the trader only needs to deposit a fraction of the total value of the trade as collateral.

For example, if a trader wants to buy 1 Bitcoin (BTC) at a price of $30,000, but they only have $1,000, they can use 30x leverage to enter the position. Instead of needing to deposit the full $30,000, the trader only needs to provide $1,000 as margin. However, they are still exposed to the full value of the trade.

The key to leveraging is that it amplifies both profits and losses. A small price movement can lead to significant gains or losses, which is why understanding leverage is crucial for managing risk effectively. airdrops crypto

Benefits of Crypto 30x Leverage

While trading with leverage can be risky, it offers several benefits that can enhance your trading strategy. Below are the primary advantages of using 30x leverage in crypto trading:

1. Increased Potential for Profit

The main attraction of leverage is the ability to control a larger position with a smaller initial investment. With 30x leverage, even small price movements can result in substantial profits. For example, if the price of Bitcoin increases by 1%, a trader using 30x leverage can see a 30% return on their $1,000 investment.

2. More Flexibility in Capital Allocation

Leverage enables traders to diversify their capital by trading larger positions without having to use all their available funds. Instead of tying up significant capital in a single trade, traders can spread their funds across multiple trades or different cryptocurrencies, increasing their exposure to potential opportunities.

3. Short-Term Trading Opportunities

Leverage is particularly appealing to short-term traders, such as day traders or swing traders, who aim to profit from small price fluctuations. Since cryptocurrency markets are highly volatile, leverage allows traders to take advantage of rapid price movements and maximize their returns.

4. Access to Higher Liquidity

By using leverage, traders can increase their liquidity without needing to deposit large amounts of capital. This allows them to take advantage of trading opportunities quickly, particularly in highly liquid markets like Bitcoin or Ethereum.

Risks of Using Crypto 30x Leverage

While the potential for profit with 30x leverage can be appealing, it comes with significant risks. Traders should fully understand these risks before engaging in leveraged crypto trading.

1. Increased Losses

Just as leverage amplifies potential profits, it also magnifies losses. A small price movement in the opposite direction can lead to massive losses. For example, if the price of Bitcoin drops by just 1% while you’re using 30x leverage, your $1,000 investment would be wiped out entirely.

This risk of liquidation is a major concern for traders who do not manage their positions carefully. Exchanges typically liquidate positions if the trader’s margin falls below a certain threshold to ensure the loan is paid back.

2. Margin Calls and Liquidation

With 30x leverage, the margin required to maintain a position is much smaller. However, if the price moves unfavorably, the trader may receive a margin call, which requires them to deposit more funds to maintain their position. If they fail to do so, the position will be liquidated, and the trader will lose their initial investment.

3. Psychological Stress

The volatility of crypto markets, combined with the potential for significant gains and losses, can lead to high levels of stress. Traders may become overly focused on short-term price movements, leading to poor decision-making and impulsive actions. Proper emotional control and risk management are critical to success when using leverage.

4. Fees and Interest Charges

Many crypto exchanges charge fees on leveraged positions, such as overnight financing costs. These fees can add up quickly and eat into any profits you might make. It’s important to consider the cost of leverage, especially when holding positions overnight or for extended periods.

How to Use Crypto 30x Leverage Effectively

To use 30x leverage effectively in cryptocurrency trading, you need to implement a robust trading strategy and risk management techniques. Below are some essential tips for using leverage safely:

1. Start Small and Gradually Increase Your Leverage

If you are new to leveraged trading, start with a smaller leverage ratio and increase it gradually as you gain more experience. This will help you understand how leverage affects your trades and allows you to learn how to manage risk.

2. Use Stop-Loss Orders

A stop-loss order is a tool that automatically closes your position if the price moves against you by a certain amount. This helps to limit your losses and prevent your position from being liquidated. It’s particularly important when using 30x leverage, as small price movements can have significant consequences. BTC AI Evex analysis

3. Diversify Your Portfolio

Avoid putting all your capital into a single trade, especially when using leverage. By diversifying your trades across different assets, you can reduce the risk of large losses from one position. Spread your leverage across different cryptocurrencies, as each market behaves differently.

4. Monitor Your Positions Regularly

Leverage requires constant monitoring, as prices can move quickly in the crypto market. Regularly checking your positions will help you stay on top of market trends and make adjustments when necessary.

5. Risk Management

Never risk more than you can afford to lose. Even with 30x leverage, it’s important to only invest what you’re willing to lose. Set clear risk parameters for each trade, and don’t allow emotions to drive your decisions.

Conclusion

Crypto 30x leverage offers exciting opportunities for traders looking to amplify their profits, but it comes with significant risks. Understanding how leverage works, the potential benefits, and the associated risks is crucial to navigating the world of leveraged crypto trading successfully. Traders should prioritize risk management, use tools like stop-loss orders, and never invest more than they can afford to lose. By approaching leveraged trading with caution and discipline, you can maximize your chances of success in the volatile world of cryptocurrency.

crypto

Is Copy Trading for Real?

Copy trading has recently gained immense popularity. At first glance, copy trading seems like the ideal investment solution, allowing people to invest without fully relying on their own expertise and mirroring professional traders’ trades automatically. But is can effective investment strategy or just another fad? Let’s unpack copy trading to determine its validity as an approach. Curious about the reliability of copy This main page connects investors with experts who break down its mechanics—how do you plan to evaluate its potential?

Assessing Authenticity: Is Copy Trading An Appropriate Investment Strategy?

Copy first gained prominence during the early 2000s as a method for novice investors to learn from experienced traders by following in their footsteps on platforms explicitly designed to enable it. At its core, involves following successful investors closely while mirroring their trades through these services.

But the question still stands–can a strategy reliant on someone else’s judgment consistently produce results? In order to answer this, one must understand that copy trading does not promise profits and should only be seen as a tool that aligns your investments with those made by experienced traders.

Take it from financial educator Sarah Johnson, who once said, “Copy is like learning to cook from a chef. Mirroring their techniques can yield great results, but only if the chef actually knows what they’re doing.” That means your success rests heavily on selecting the right investor to follow.

Transparency is another consideration. Platforms offering copy must disclose the historical performance of traders you aim to copy. Some platforms go a step further, offering risk scores and detailed analytics to guide decisions. Be cautious and always verify the credibility of both the platform and the trader you’re copying.

Advantages Of Engaging In Copy Trading

Why has copy attracted thousands of investors? There are several reasons why it feels appealing, especially for those new to the market.

- Accessibility for Beginners: You don’t need to be an expert in stocks, commodities, or forex to start. Beginners can piggyback on the expertise of seasoned traders.

- Learning Opportunity: While you’re copying trades, you’re also learning. Watching market decisions in real-time can help you understand patterns and strategies over time.

- Time Saving: For individuals juggling work, family and other obligations simultaneously, keeping close tabs on investments may not be feasible; in such a situation, copy trading offers an easy alternative while still participating in active markets.

- Diversification: You can diversify by following multiple traders who specialize in different markets or strategies, spreading out the risk across a range of assets.

However, even the most attractive benefits come with tradeoffs. While copy trading makes investing easier for some investors, it still requires effort and dedication for success; simply following someone else’s portfolio without understanding its strategy could prove disastrous.

Navigating Risks And Challenges In Copy Trading

Copy trading can present its share of challenges. Betting any amount on someone else’s decisions entails risks that you cannot predict; be wary if anyone offers you money.

No Strategy Is Foolproof

Even expert traders can make bad calls. Markets are unpredictable at the best of times, and following someone else doesn’t provide immunity against losses.

Over-Reliance On Others’ Decisions

While convenience is appealing, depending entirely on another person’s strategies means you might not build your own investment acumen. If the trader you’re following falls out of the market, you could be left scrambling.

Hidden Costs

Some platforms impose fees for using copy-trading features. These costs might pile up over time and reduce the overall return on your investment.

Mismatched Risk Preferences

An expert trader’s risk tolerance could differ greatly from your own. For example, if you’re a conservative investor following someone more aggressive, their strategies could leave you in financial discomfort.

“Trust, but verify,” says investment advisor Michael Kingsley. “Don’t follow a trader simply because their profile looks shiny. Dig deeper. Ask questions like, ‘What’s their risk level? Do their previous results match what I’m comfortable with?’”

Ultimately, copy trading works best when approached with caution and thoughtfulness. Research is your friend. Look for platforms with a solid reputation and take the time to assess traders based on performance, experience, and risk appetite.

Asking The Big Question

Given all the advantages and risks, part of deciding if copy trading is “real” comes down to asking the right questions. Here are some to get you started:

- Does the platform have safeguards in place to manage risks?

- Is there transparency in a trader’s performance statistics?

- How does copying align with my financial goals and risk tolerance?

- Am I willing to invest time in monitoring and evaluating the traders I follow?

Remember, informed investing is responsible investing.

What Should You Do Next?

Instead of jumping into copy trading without preparation, start by doing your homework. Explore reputable platforms, read reviews, and even consult a financial expert. Remember the golden rule of investing—never risk more than you’re ready to lose. Choosing where your money flows is a decision worthy of time and care.

Copy trading is neither a shortcut to riches nor a guaranteed path to failure. It’s a tool, and much like any tool, its effectiveness depends entirely on how you use it.

Conclusion

Copy trading offers a tempting shortcut for beginners, but it’s not a guaranteed ticket to success. While it can help tap into expert strategies, blindly following others comes with risks. Understanding the process and choosing wisely are key. In the end, copy trading can be real, but it works best when combined with research and a clear investment strategy.

-

Tech5 months ago

Tech5 months agoFintechZoom.com – Your Ultimate Guide to Financial News and Insights

-

Tech4 months ago

Tech4 months agoKittl Design: A Simple Guide to Boosting Your Creative Projects

-

Celebrity4 months ago

Celebrity4 months agoWhat Disease Does Michael Keaton Have?

-

Tech5 months ago

Tech5 months agoHow to Track a Phone Number on Google Maps

-

Tech4 months ago

Tech4 months agoCute Canva Fonts: A Guide to Adding Charm to Your Designs

-

Blog4 months ago

Blog4 months agoTimberwolves vs Phoenix Suns Match Player Stats

-

Entertainment4 months ago

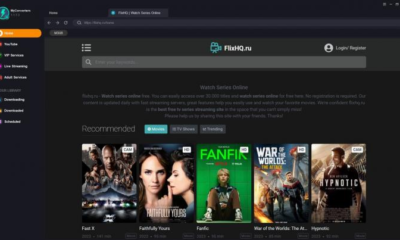

Entertainment4 months agoFlixHQ – Top 10 FlixHQ Alternatives to Watch HD Movies and TV Shows in 2025

-

Tech4 months ago

Tech4 months agoCute Fonts on Canva: A Guide to Adorable Typography for Your Designs