crypto

Is Copy Trading for Real?

Copy trading has recently gained immense popularity. At first glance, copy trading seems like the ideal investment solution, allowing people to invest without fully relying on their own expertise and mirroring professional traders’ trades automatically. But is can effective investment strategy or just another fad? Let’s unpack copy trading to determine its validity as an approach. Curious about the reliability of copy This main page connects investors with experts who break down its mechanics—how do you plan to evaluate its potential?

Assessing Authenticity: Is Copy Trading An Appropriate Investment Strategy?

Copy first gained prominence during the early 2000s as a method for novice investors to learn from experienced traders by following in their footsteps on platforms explicitly designed to enable it. At its core, involves following successful investors closely while mirroring their trades through these services.

But the question still stands–can a strategy reliant on someone else’s judgment consistently produce results? In order to answer this, one must understand that copy trading does not promise profits and should only be seen as a tool that aligns your investments with those made by experienced traders.

Take it from financial educator Sarah Johnson, who once said, “Copy is like learning to cook from a chef. Mirroring their techniques can yield great results, but only if the chef actually knows what they’re doing.” That means your success rests heavily on selecting the right investor to follow.

Transparency is another consideration. Platforms offering copy must disclose the historical performance of traders you aim to copy. Some platforms go a step further, offering risk scores and detailed analytics to guide decisions. Be cautious and always verify the credibility of both the platform and the trader you’re copying.

Advantages Of Engaging In Copy Trading

Why has copy attracted thousands of investors? There are several reasons why it feels appealing, especially for those new to the market.

- Accessibility for Beginners: You don’t need to be an expert in stocks, commodities, or forex to start. Beginners can piggyback on the expertise of seasoned traders.

- Learning Opportunity: While you’re copying trades, you’re also learning. Watching market decisions in real-time can help you understand patterns and strategies over time.

- Time Saving: For individuals juggling work, family and other obligations simultaneously, keeping close tabs on investments may not be feasible; in such a situation, copy trading offers an easy alternative while still participating in active markets.

- Diversification: You can diversify by following multiple traders who specialize in different markets or strategies, spreading out the risk across a range of assets.

However, even the most attractive benefits come with tradeoffs. While copy trading makes investing easier for some investors, it still requires effort and dedication for success; simply following someone else’s portfolio without understanding its strategy could prove disastrous.

Navigating Risks And Challenges In Copy Trading

Copy trading can present its share of challenges. Betting any amount on someone else’s decisions entails risks that you cannot predict; be wary if anyone offers you money.

No Strategy Is Foolproof

Even expert traders can make bad calls. Markets are unpredictable at the best of times, and following someone else doesn’t provide immunity against losses.

Over-Reliance On Others’ Decisions

While convenience is appealing, depending entirely on another person’s strategies means you might not build your own investment acumen. If the trader you’re following falls out of the market, you could be left scrambling.

Hidden Costs

Some platforms impose fees for using copy-trading features. These costs might pile up over time and reduce the overall return on your investment.

Mismatched Risk Preferences

An expert trader’s risk tolerance could differ greatly from your own. For example, if you’re a conservative investor following someone more aggressive, their strategies could leave you in financial discomfort.

“Trust, but verify,” says investment advisor Michael Kingsley. “Don’t follow a trader simply because their profile looks shiny. Dig deeper. Ask questions like, ‘What’s their risk level? Do their previous results match what I’m comfortable with?’”

Ultimately, copy trading works best when approached with caution and thoughtfulness. Research is your friend. Look for platforms with a solid reputation and take the time to assess traders based on performance, experience, and risk appetite.

Asking The Big Question

Given all the advantages and risks, part of deciding if copy trading is “real” comes down to asking the right questions. Here are some to get you started:

- Does the platform have safeguards in place to manage risks?

- Is there transparency in a trader’s performance statistics?

- How does copying align with my financial goals and risk tolerance?

- Am I willing to invest time in monitoring and evaluating the traders I follow?

Remember, informed investing is responsible investing.

What Should You Do Next?

Instead of jumping into copy trading without preparation, start by doing your homework. Explore reputable platforms, read reviews, and even consult a financial expert. Remember the golden rule of investing—never risk more than you’re ready to lose. Choosing where your money flows is a decision worthy of time and care.

Copy trading is neither a shortcut to riches nor a guaranteed path to failure. It’s a tool, and much like any tool, its effectiveness depends entirely on how you use it.

Conclusion

Copy trading offers a tempting shortcut for beginners, but it’s not a guaranteed ticket to success. While it can help tap into expert strategies, blindly following others comes with risks. Understanding the process and choosing wisely are key. In the end, copy trading can be real, but it works best when combined with research and a clear investment strategy.

crypto

FTAsiaStock Crypto: The Ultimate Platform for Stock and Crypto Trading

In the rapidly evolving financial landscape, FTAsiaStock Crypto has emerged as a pioneering platform that seamlessly integrates traditional stock trading with cryptocurrency investments. This hybrid approach offers investors a diversified portfolio, combining the stability of conventional stocks with the high growth potential of digital assets.

What is FTAsiaStock Crypto?

FTAsiaStock Crypto is an all-encompassing investment platform that enables users to trade both traditional stock market assets and cryptocurrencies within a single ecosystem. This integration simplifies the investment process, allowing for efficient portfolio management and real-time market analysis across diverse asset classes.

Key Features of FTAsiaStock Crypto

-

Integrated Portfolio Management: Users can monitor, trade, and manage their stocks and cryptocurrencies in one unified interface, eliminating the need for multiple platforms.

-

Real-Time Market Data: The platform provides live price updates, market insights, and trend analyses, empowering investors to make informed decisions.

-

Secure Transactions with Blockchain Technology: Leveraging blockchain ensures secure, transparent, and immutable transactions, enhancing user trust.

-

User-Friendly Interface: Designed for both beginners and seasoned investors, the intuitive interface facilitates seamless trading and investment activities.

-

Automated Trading Options: AI-driven automated trading strategies are available for those preferring a passive investment approach, optimizing portfolio performance.

Benefits of Using FTAsiaStock Crypto

-

Diversification for Risk Management: Combining stocks and cryptocurrencies allows for better risk distribution, mitigating the impact of market volatility.

-

Increased Liquidity: Investors can effortlessly switch between asset classes, capitalizing on market opportunities without unnecessary delays.

-

Advanced Trading Tools: Comprehensive charting tools, analytical reports, and AI-driven insights enable effective investment optimization.

-

Cost-Effective Transactions: The platform ensures low transaction fees, making it more economical compared to using separate stock and crypto exchanges.

Security Measures

FTAsiaStock Crypto prioritizes user security by employing multi-layer encryption, two-factor authentication (2FA), and blockchain verification to safeguard transactions and personal data.

Getting Started with FTAsiaStock Crypto

-

Sign Up: Create an account on the FTAsiaStock Crypto platform.

-

Verify Identity: Complete KYC verification for enhanced security.

-

Fund Account: Deposit funds using traditional currency or cryptocurrency.

-

Start Trading: Begin buying, selling, and managing investments seamlessly.

-

Monitor and Optimize: Utilize analytical tools to track market trends and maximize returns.

FTAsiaStock Crypto is redefining the investment landscape by bridging traditional finance and digital assets. Its innovative hybrid platform, robust security measures, and user-centric design make it a compelling choice for investors seeking a comprehensive and diversified investment experience.

How FTAsiaStock Crypto Stands Out from Competitors

With numerous crypto and stock trading platforms available, FTAsiaStock Crypto differentiates itself by offering:

- A Unified Trading Ecosystem: Unlike other platforms that focus solely on either crypto or stocks, FTAsiaStock Crypto allows investors to manage both asset classes seamlessly.

- AI-Powered Investment Insights: Advanced AI-driven analytics help users optimize their investment strategies, providing real-time risk assessments and predictive market trends.

- High-Speed Transactions: The platform ensures fast order execution with minimal latency, allowing traders to capitalize on rapid market movements.

- Regulatory Compliance: FTAsiaStock Crypto operates within a regulated framework, ensuring legal compliance and fostering user trust.

FTAsiaStock Crypto Investment Strategies

Investing in both stocks and cryptocurrencies requires a strategic approach. Here are some recommended investment strategies for users of FTAsiaStock Crypto:

1. Balanced Portfolio Strategy

- Allocate a portion of your funds to stable, blue-chip stocks while keeping a percentage in high-growth cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

- This strategy provides stability while allowing exposure to crypto’s high return potential.

2. Day Trading for Quick Profits

- Utilize real-time market data to engage in short-term trading.

- The platform’s low-latency transactions and AI-powered insights make it easier for traders to take advantage of price fluctuations.

3. HODL (Long-Term Holding) Strategy

- Invest in fundamentally strong stocks and cryptocurrencies with long-term potential.

- This strategy is best for those who prefer lower risk and steady growth.

4. Dollar-Cost Averaging (DCA)

- Invest fixed amounts at regular intervals instead of making lump-sum investments.

- Helps mitigate the impact of market volatility.

FTAsiaStock Crypto’s Future Prospects

With the growing adoption of blockchain and increasing institutional interest in cryptocurrencies, platforms like FTAsiaStock Crypto are well-positioned for expansion. The integration of AI, DeFi (Decentralized Finance), and NFTs could further enhance investment opportunities.

Future updates may include:

- Integration of More Crypto Assets: Expansion beyond mainstream cryptocurrencies to include promising altcoins and DeFi tokens.

- Staking and Yield Farming: Allowing users to earn passive income on their holdings.

- Mobile App Development: A dedicated mobile app for enhanced user experience.

Conclusion

FTAsiaStock Crypto is revolutionizing the way investors approach the financial markets by offering a unique blend of traditional stock trading and cryptocurrency investments. Its cutting-edge technology, security measures, and user-centric features make it an ideal platform for both beginners and experienced investors.

If you are looking for a versatile and reliable investment platform that bridges the gap between traditional finance and digital assets, FTAsiaStock Crypto is a promising option to explore.

YOU MAY ALSO READ:

-

Tech5 months ago

Tech5 months agoFintechZoom.com – Your Ultimate Guide to Financial News and Insights

-

Tech4 months ago

Tech4 months agoKittl Design: A Simple Guide to Boosting Your Creative Projects

-

Celebrity4 months ago

Celebrity4 months agoWhat Disease Does Michael Keaton Have?

-

Tech5 months ago

Tech5 months agoHow to Track a Phone Number on Google Maps

-

Tech4 months ago

Tech4 months agoCute Canva Fonts: A Guide to Adding Charm to Your Designs

-

Blog4 months ago

Blog4 months agoTimberwolves vs Phoenix Suns Match Player Stats

-

Entertainment4 months ago

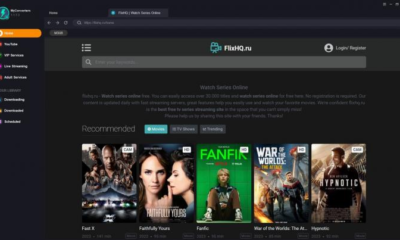

Entertainment4 months agoFlixHQ – Top 10 FlixHQ Alternatives to Watch HD Movies and TV Shows in 2025

-

Tech4 months ago

Tech4 months agoCute Fonts on Canva: A Guide to Adorable Typography for Your Designs